Washington region posts gains as home prices still falling in most U.S. cities

By Dina ElBoghdady

Washington Post Staff Writer

Wednesday, December 29, 2010; 12:56 AM

The Washington region posted the highest year-over-year home price gains in the nation this fall, as real estate values slumped in nearly every other metropolitan area, a key housing report said Tuesday.

A healthy job market, particularly for high-salaried workers, buoyed demand and prices for housing in the D.C. area, local economists said. Home values climbed 3.7 percent in Washington in October from a year earlier, making it one of only four regions nationally to avoid a dip in prices, the Standard & Poor's Case-Shiller home-price index said.

read this article...

U.S. home prices drop 1.3% from September to October

By Dina ElBoghdady

Washington Post Staff Writer

Tuesday, December 28, 2010; 10:37 AM

Home prices fell in the nation's major metropolitan areas from September to October, with six regions hitting new lows, and they're not expected to rebound anytime soon.

The Standard & Poor's/Case-Shiller index, long considered a reliable gauge of the housing market's health, reported Tuesday that prices of single-family homes dropped 1.3 percent in all 20 regions it tracks.

The housing market's collapse crippled the economy, and a recovery in home prices is considered critical to getting the market back on track. But many economists predict that home prices will continue to fall into the new year and possibly beyond.

more from Washington Post.com, view video

SAAB REALTORS is the Washington DC Metropolitan Area premier real estate Solutions Company located in Vienna, VA. Our company specializes in foreclosure avoidance and is the foremost expert in this arena. SAAB REALTORS is a member of the Better Business Bureau and has been an integral part of the community for years. Call us today at 703.288.4877 and we can discuss your options!

Wednesday, December 29, 2010

Tuesday, December 28, 2010

Best Places to Live: Best places for the rich and single in 2010

We're not saying you're a gold digger. But you could follow the money to these 25 affluent cities, where singles are abundant.

Ranked #11. Arlington, VA

Population: 212,173

Single: 41.6%

Median family income: $104,452

Just a stone's throw from the nation's capital, Arlington is packed with Washington's movers and shakers, especially Department of Defense workers from the nearby Pentagon. Wind down with wonks at a pub on Wilson Boulevard. For a rowdier night, hit one of several live-music venues and comedy clubs -- or take to the dance floor at Clarendon Ballroom, which also boasts a rooftop bar. If you're more into the artsy scene, walk across the Roosevelt Bridge and catch a world-renowned music or theater performance at the Kennedy Center across the Potomac River. --H.Y.

read more...

Ranked #11. Arlington, VA

Population: 212,173

Single: 41.6%

Median family income: $104,452

Just a stone's throw from the nation's capital, Arlington is packed with Washington's movers and shakers, especially Department of Defense workers from the nearby Pentagon. Wind down with wonks at a pub on Wilson Boulevard. For a rowdier night, hit one of several live-music venues and comedy clubs -- or take to the dance floor at Clarendon Ballroom, which also boasts a rooftop bar. If you're more into the artsy scene, walk across the Roosevelt Bridge and catch a world-renowned music or theater performance at the Kennedy Center across the Potomac River. --H.Y.

read more...

Ranked #14. Towson, MD

Population: 52,301Single: 35.4% Median family income: $102,302

Do you think the brain is the sexiest part of the body? This small community near Baltimore boasts a significant population of professors as the home of Towson University and Goucher College, two of the biggest employers in the area. On Friday nights, academics loosen their bow ties and swing by Towson's Feet on the Street block parties featuring local bands. After the party winds down, crowds saunter down Allegheny Avenue, the town's main downtown strip, to local eateries and bars. --H.Y.

read more...

Do you think the brain is the sexiest part of the body? This small community near Baltimore boasts a significant population of professors as the home of Towson University and Goucher College, two of the biggest employers in the area. On Friday nights, academics loosen their bow ties and swing by Towson's Feet on the Street block parties featuring local bands. After the party winds down, crowds saunter down Allegheny Avenue, the town's main downtown strip, to local eateries and bars. --H.Y.

read more...

CNN MONEY: Best Places to Live in 2010 - Money's list of America's best small cities

And the winners are...

These terrific small cities -- even now -- boast plenty of jobs, great schools, safe streets, low crime, lots to do, charm, and other features that make a town great for raising a family.

read more...

Ranked #30. Centreville, VA

Population: 54,000

Compare Centreville to Top 10 Best Places

This historic town (it has some Civil War sites) is a close-knit suburban community with a great location.

This historic town (it has some Civil War sites) is a close-knit suburban community with a great location.

Ranked #47. Alexandria, VA

These terrific small cities -- even now -- boast plenty of jobs, great schools, safe streets, low crime, lots to do, charm, and other features that make a town great for raising a family.

| 1. Eden Prairie, MN 2. Columbia/Ellicott City, MD 3. Newton, MA 4. Bellevue, WA 5. McKinney, TX | 6. Fort Collins, CO 7. Overland Park, KS 8. Fishers, IN 9. Ames, IA 10. Rogers, AR |

Best Places to Live in 2010 : Top 100 - full list

Ranked 25. Gaithersburg, MD

Top 100 rank: 25

Population: 59,000

Compare Gaithersburg to Top 10 Best Places

Gaithersburg's ability to attract start-up companies has allowed it to rebound from the recession better than many other places. The town offers plenty of incubator-styled office space.

Large employers nearby include Northrop Grumman and Lockheed Martin.

Gaithersburg is just an hour's train ride to D.C. and hour car ride to downtown Baltimore, so residents can work in either town - and soak up the culture of both. --Najib Aminy

Ranked #30. Centreville, VA

Population: 54,000

Compare Centreville to Top 10 Best Places

This historic town (it has some Civil War sites) is a close-knit suburban community with a great location.

This historic town (it has some Civil War sites) is a close-knit suburban community with a great location. Washington, D.C., is anywhere from 40 minutes to an hour and a half away, depending on traffic. Centerville is also 20 minutes from Herndon, Tysons Corner, and Reston.

With major shopping centers nearby and the Bull Run Mountains an hour's drive away, Centerville lives up to its name. --N.A.

Ranked #47. Alexandria, VA

op 100 rank: 47

Population: 145,000

Compare Alexandria to Top 10 Best Places

On the banks of the Potomac River, Alexandria offers a fusion of suburban and urban living that's just a stone's throw from the nation's capitol.

CNN Money: Top-earning towns 2010

Ranked #1. Bethesda, MD

Bethesda, Md., residents pull in more than $170,000 a year. Which other places in our Best Places database have high incomes?

Population: 56,763Median family income (per year): $172,541

Median home price: $725,000

There's a party for every season in this commuter town: Enjoy concerts and ice sculpting in the winter and Taste of Bethesda in October; schmooze with Pulitzer Prize winning authors at April's literary festival; and enjoy the strains of delta blues, soul and swing in the summer.

There's a party for every season in this commuter town: Enjoy concerts and ice sculpting in the winter and Taste of Bethesda in October; schmooze with Pulitzer Prize winning authors at April's literary festival; and enjoy the strains of delta blues, soul and swing in the summer. Year-round a dozen art galleries and hundreds of diverse restaurants woo suburbanites away from cul-de-sac comforts for days and nights downtown. An abundance of home fashion stores and graduate degrees (one in two residents has one) sets a swanky tone for this small community with big city style.

read more...

read more...

Ranked #9. Burke, VA

Population: 54,974

Median family income (per year): $127,036

Median home price: $335,000

This upscale community is a haven for government officials and federal contractors seeking a break from the capitol. But it also attracts residents who work for local businesses in nearby Arlington.The living is easy in this town, which puts shopping, pools, sports fields and footpaths within convenient reach. The prototypical suburb, it boasts great schools, high-end shops and well-tended footpaths.

This upscale community is a haven for government officials and federal contractors seeking a break from the capitol. But it also attracts residents who work for local businesses in nearby Arlington.The living is easy in this town, which puts shopping, pools, sports fields and footpaths within convenient reach. The prototypical suburb, it boasts great schools, high-end shops and well-tended footpaths.

Burke Centre Conservancy, a 1,700-acre planned residential community with 5 neighborhoods, pools and community centers is at the heart of it all.

read more...

Ranked # 16. Reston, VA

Median family income (per year): $127,036

Median home price: $335,000

This upscale community is a haven for government officials and federal contractors seeking a break from the capitol. But it also attracts residents who work for local businesses in nearby Arlington.

This upscale community is a haven for government officials and federal contractors seeking a break from the capitol. But it also attracts residents who work for local businesses in nearby Arlington.Burke Centre Conservancy, a 1,700-acre planned residential community with 5 neighborhoods, pools and community centers is at the heart of it all.

read more...

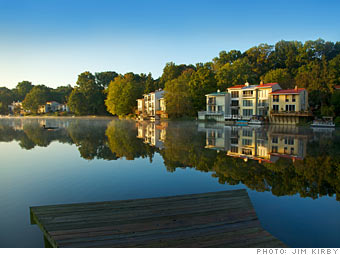

Ranked # 16. Reston, VA

Population: 58,718 Median family income (per year): $122,212

Median home price: $268,000

Neither a town nor a city, this unincorporated community has forged its identity since the mid-1960s when it first began wooing residents to its open air and neighborhood amenities.

Today it still stands apart with a special approach to governance. The Reston Association, a community service organization overseen by elected community members, maintains the high quality of life locals expect.

Environmental excellence has long been its claim to fame, but it pushed that distinction to new heights with the opening of Nature House, a LEED Gold certified year-round environmental education center.

read more...

Ranked #21. Ellicott City, MD

Median home price: $268,000

Neither a town nor a city, this unincorporated community has forged its identity since the mid-1960s when it first began wooing residents to its open air and neighborhood amenities.

Today it still stands apart with a special approach to governance. The Reston Association, a community service organization overseen by elected community members, maintains the high quality of life locals expect.

Environmental excellence has long been its claim to fame, but it pushed that distinction to new heights with the opening of Nature House, a LEED Gold certified year-round environmental education center.

read more...

Ranked #21. Ellicott City, MD

Population: 62,179

Median family income (per year): $116,820

Median home price: $380,000

From Art Deco to Victorian, this town's architecture is rich in tradition. Locals enjoy reveling in history, whether feasting on local cuisine at the Trolley Stop (originally built as a tavern in 1833) or trading ghost stories about residents of old who died in fires, floods and the Civil War.

From Art Deco to Victorian, this town's architecture is rich in tradition. Locals enjoy reveling in history, whether feasting on local cuisine at the Trolley Stop (originally built as a tavern in 1833) or trading ghost stories about residents of old who died in fires, floods and the Civil War.

Median family income (per year): $116,820

Median home price: $380,000

From Art Deco to Victorian, this town's architecture is rich in tradition. Locals enjoy reveling in history, whether feasting on local cuisine at the Trolley Stop (originally built as a tavern in 1833) or trading ghost stories about residents of old who died in fires, floods and the Civil War.

From Art Deco to Victorian, this town's architecture is rich in tradition. Locals enjoy reveling in history, whether feasting on local cuisine at the Trolley Stop (originally built as a tavern in 1833) or trading ghost stories about residents of old who died in fires, floods and the Civil War. Founded in 1772, Ellicott City lays claim to the oldest railroad terminus and operating flourmill in the country. With roots so deep, it's no surprise that its antique mall wins rave reviews too.

Real Estate News brought to you by CNN Money

• Welcome to Zombieland: Ladera Ranch, California • Foreclosure freeze coming • Should you gift your kid a down payment? • House hunters are too scared to buy despite low prices • Buy a foreclosure - save 30% on the price • Mortgage tax break in the crosshairs • Home prices fall 2% • Foreclosure scandal impact: Sales dry up • New home sales: Down 80% from the boom • Existing home sales slow down • Add 2.1 million houses to the glut • Improve your home for the holidays • Most (and least) affordable cities • Fewer homeowners behind on payments • It doesn't pay to remodel your home • Servicers must improve loan modifications, say state AGs • Foreclosure mess prompts call for stress tests • Canada's coming housing bust • Repossessions fall 9% in October • Home sales plummet 25% • Million-dollar homes: Massive discounts • Pay down the mortgage or save for retirement? • Homebuilders' survival lessons • Get a high-quality remodel for less • How one city dodged the recession • What the election means for foreclosures and robo-signing • Buy a wreck: 5 foreclosure specials • 3 ways low mortgage rates can work for you • American dream fades for more as homeownership falls | • Obama administration sings new tune on foreclosures • Home prices expected to slide another 8% • Foreclosure? Don't worry. You can still vote • Befuddled by foreclosures? • Australians swoop in on U.S. foreclosures • I was a robo-signer • Sin City is still foreclosure central • Wells Fargo to update foreclosure docs • New home sales in slow recovery • Google eyes purchase of massive NY building - report • Home prices sag • Obama mortgage mods dwindle • Existing home sales on the rise • Robo-signing: Just the start of bigger problems How to buy a foreclosure in a robo-signing world • We'd like to return these bad loans, please • Buy a foreclosure in a robo-signing world • What $1 million buys in a blighted neighborhood • Foreclosure mess: Fake signatures and lavish gifts • U.S. eyes criminal violations in foreclosure crisis • Illinois sheriff may halt evictions • You're not getting your house back • Foreclosure probe: Problems aren't 'systemic' • Housing mess: You can't stay if you don't pay • Housing starts hit 5-month high • Countrywide's Mozilo to pay $67.5 million settlement • Ohio AG to Ally: Stop foreclosure sales |

Home price plunge is widespread

10:46am: Prices drop in all 20 key cities in the S&P/Case-Shiller index, a sign that a double dip in housing is coming -- or has already arrived.

New home sales climb - but recovery is sluggish

Dec 23: New home sales edged higher in November, the government reported Thursday, but the recovery remains sluggish from a year ago.

Hooray? Higher mortgage rates spurred home sales uptick

Dec 23: The country's economic engine seems to be running in reverse as more expensive borrowing spurs home sales, and an uptick in borrowing sends mortgage rates back down. More

Home sales creep up - but are still off 30%

Dec 22: Existing home sales picked up steam in November but are still down nearly 30% from this time last year, an industry report said Tuesday.

America's most overvalued cities

Jan 27: Most markets were overvalued four years ago. No more. In the majority of markets now, homes sell at a discount to their fair market price.

more...

Buying a Home: Top things to know - brought to you by CNN Money

| 1. Don't buy if you can't stay put. 2. Start by shoring up your credit. 3. Aim for a home you can really afford. 4. If you can't put down the usual 20 percent, you may still qualify for a loan. 5. Buy in a district with good schools. | 6. Get professional help. 7. Choose carefully between points and rate. 8. Before house hunting, get pre-approved. 9. Do your homework before bidding. 10. Hire a home inspector. |

NEXT: Are you ready to own?

view article

Thursday, December 23, 2010

Make your own White House holiday decor

The Washington Post's Jura Koncius talks with the White House Chief Floral Designer about two holiday decorations that can be made at home. (Anna Uhls/The Washington Post)

click here...

Google Voice will have Santa call any of your friends...

Just for fun - Google Voice will have Santa call any of your friends and give them a custom message that includes their name and details about them. It's a fascinating use of technology - and a lot of fun. Check it out at SendACallFromSanta.com

Wednesday, December 15, 2010

Washington area is wealthiest and most educated region in the nation, census data show

Washington Post Staff Writers

Wednesday, December 15, 2010; 12:05 AM

During that period, Fairfax and Loudoun were the only two U.S. counties with median household incomes surpassing $100,000. Tiny Falls Church, which is an independent city and counted separately, had that median income level, as well. Five of the region's suburban counties - Fairfax, Arlington, Loudoun, Montgomery and Howard - plus Alexandria and Falls Church, were among 17 places in the United States in which more than half of the residents have at least a bachelor's degree.

In Loudoun, more than a third of the households are married couples with children, making it one of the country's bastions of the traditional family. The District, Baltimore and Richmond reflected the other extreme, with nuclear families making up fewer than one in 10 households.

The census data released Tuesday offer a more intimate glimpse of hundreds of the Washington region's neighborhoods than has been available. Among other things, the data will be used to provide a better understanding of segregation in the area and other U.S. communities.

The figures combine information gathered from 2005 to 2009 in the American Community Survey, a detailed questionnaire mailed monthly to a cross section of Americans.

read more...

Tuesday, December 14, 2010

U.S. foreclosure-prevention program fell short, Congressional Oversight Panel says

By Brady Dennis

Washington Post Staff Writer

Tuesday, December 14, 2010; 1:29 AM

The Treasury Department's primary foreclosure-prevention program has failed to live up to expectations and has suffered from a lack of "meaningful goals," according to a report from a congressional watchdog panel due out Tuesday.

The government's Home Affordable Modification Program, or HAMP, is on pace to prevent 700,000 to 800,000 foreclosures - a significant figure, but far fewer than the 3 million to 4 million struggling homeowners Treasury officials originally hoped to help, according to the bipartisan Congressional Oversight Panel.

"This has turned out to be a lot more complicated and a lot harder" than expected, the panel's chairman, Sen. Ted Kaufman (D-Del.), told reporters. He said he didn't consider HAMP a "failure" because it had helped many homeowners, but he added, "I think the program has just turned out to be smaller and has had a lot less impact" than anticipated.

read more...

Washington Post Staff Writer

Tuesday, December 14, 2010; 1:29 AM

The Treasury Department's primary foreclosure-prevention program has failed to live up to expectations and has suffered from a lack of "meaningful goals," according to a report from a congressional watchdog panel due out Tuesday.

The government's Home Affordable Modification Program, or HAMP, is on pace to prevent 700,000 to 800,000 foreclosures - a significant figure, but far fewer than the 3 million to 4 million struggling homeowners Treasury officials originally hoped to help, according to the bipartisan Congressional Oversight Panel.

"This has turned out to be a lot more complicated and a lot harder" than expected, the panel's chairman, Sen. Ted Kaufman (D-Del.), told reporters. He said he didn't consider HAMP a "failure" because it had helped many homeowners, but he added, "I think the program has just turned out to be smaller and has had a lot less impact" than anticipated.

read more...

Friday, December 10, 2010

Holiday Guide

Holiday decor at the White House

Click Here to view Holiday Guide

Gift Guides | Food & Entertaining | Fashion |

Activities | Seasonal Survival | Movie Guide

Gadget & Game Guide

Click Here to view Holiday Guide

Gift Guides | Food & Entertaining | Fashion |

Activities | Seasonal Survival | Movie Guide

Gadget & Game Guide

Housing agencies clash over mortgage-relief program

By Dina ElBoghdady and Zachary A. Goldfarb

Washington Post Staff Writers

Friday, December 10, 2010; 1:07 AM

The top federal agencies responsible for setting housing policy are clashing over a new program designed to help borrowers whose homes are worth less than they owe on their mortgages, according to industry and government sources.

The Federal Housing Administration says the program could avert foreclosures, but the Federal Housing Finance Agency has concerns that the program, if expanded to include the government-controlled mortgage giants Fannie Mae and Freddie Mac, could be a logistical nightmare that would cost taxpayers too much, the sources said.

About one in four borrowers is underwater. Without equity in their homes, these borrowers tend to be vulnerable to foreclosure because it is difficult for them to refinance or sell their homes. Housing advocates have said that helping these borrowers is important to stem the nation's foreclosure tide.

At issue is an FHA program launched in September that would allow some underwater borrowers who are current on their mortgages to refinance into more-affordable loans with a smaller loan balance and lower interest rate.

The agency, which answers to President Obama, says the program is an intelligent approach to avoid foreclosures among borrowers whose homes have substantially declined in value.

read more...

click here to watch video

Washington Post Staff Writers

Friday, December 10, 2010; 1:07 AM

The top federal agencies responsible for setting housing policy are clashing over a new program designed to help borrowers whose homes are worth less than they owe on their mortgages, according to industry and government sources.

The Federal Housing Administration says the program could avert foreclosures, but the Federal Housing Finance Agency has concerns that the program, if expanded to include the government-controlled mortgage giants Fannie Mae and Freddie Mac, could be a logistical nightmare that would cost taxpayers too much, the sources said.

About one in four borrowers is underwater. Without equity in their homes, these borrowers tend to be vulnerable to foreclosure because it is difficult for them to refinance or sell their homes. Housing advocates have said that helping these borrowers is important to stem the nation's foreclosure tide.

At issue is an FHA program launched in September that would allow some underwater borrowers who are current on their mortgages to refinance into more-affordable loans with a smaller loan balance and lower interest rate.

The agency, which answers to President Obama, says the program is an intelligent approach to avoid foreclosures among borrowers whose homes have substantially declined in value.

read more...

click here to watch video

Thursday, December 9, 2010

October 2010 Northern Virginia MarketWatch

October 2010 Real Estate Market Statistics for:

- Alexandria City, VA

- Arlington County, VA

- Fairfax City, VA

- Fairfax County, VA

- Falls Church City, VA

- Loudoun County, VA

- Manassas City, VA

- Manassas Park City, VA

- Prince William County, VA

5 Things to Do Now in Order to Buy a Home in 2011

Ask Tara @Trulia

make smart decisions w/Tara's real estate + mortgage need-to-knows

Brought to you by Trulia.

There are lots of purchases that are highly prone to impulse buying: shoes on sale, puppies at the pound, and carrot cupcakes with cream cheese buttercream frosting come instantly to mind. (But that's just me.)

But houses? Not so much. Savvy, regret-free homebuying can take weeks or months of financial and lifestyle research and planning. If you want 2011 to be the year you become a homeowner, here are 5 things you should be doing, as we speak.

1. Minimize your holiday spending and save your cash. Instead of using the holiday sales to acquire a new winter wardrobe of cashmere sweaters, hold the discretionary spending down so you can give yourself the gift of homeownership! If you are serious about buying a home next year, don't run up additional credit card debt on gifts this year. Instead, make homemade cards or write holiday letters this year for everyone except the kiddos. And even for the kids, consider scaling back on the stuff, spending more of your time with them than your money, and getting started now saving toward your home purchase. (I don't think too many folks would argue that a less materialistic holiday season would hurt anyone, at any age.)

Kickstart your 2011 homebuying resolution by starting a "Home" savings account at an high-interest, online bank (the discipline-boosting goal is a bank that isn't super easy to transfer funds out of when you run low on cash), and set up an automatic deposit into it every payday. To get specific about your savings goal, if you're cash-flush, obviously a 20% down payment will get you top notch interest rates and provide you with the maximum ability to manage your monthly payments. If you're going to be more of a bootstrapping buyer, an FHA loan might be right up your alley - they offer a down payment of 3.5% of the purchase price.

All buyers should plan to have at least 3 percent of the purchase price saved up for closing costs, even if you want the seller to chip in. The lower-priced the home you want to buy, the more percentage points you should be willing to chip in for closing costs. It's easy for closing costs on an $150,000 FHA loan to run as high as $4,000 or more, considering transfer taxes, inspections, appraisals and mortgage insurance fees. So, even the scrappiest buyer should have a savings target somewhere around 6.5% of their target home's price. To buy a $200,000 home, for example, that would mean a savings target of $13,000.

Local real estate and mortgage pros can help you clarify realistic "cash to close" expectations and savings targets for your area - ask them, on Trulia Voices.

2. Research financing, areas homes, prices, agents and online. Smart homebuying takes a lot of research and knowledge-gathering. Since most buyers find it much harder to qualify for a mortgage than it is to find a home you'd love to live in, start with studying up on home financing and what it will take for you to get a home loan (note: FHA loans are preferred by the average homebuyer on today's market who has less than a 10% down payment, so start your research there).

If you're considering relocating next year, now's the time to start narrowing down states, cities and even neighborhoods that may or may not work for you. Take into account the job market, housing and other costs of living, and income and property tax rates, as well as the critical lifestyle inputs that vary from state-to-state, like weather and whether the place is a personality fit for you and the life you want to live, be it urban sophisticate or outdoors adventurer.

Also, start to develop a feel for home prices in a what-you-get-for-your-money type way, and start narrowing down the home styles and even neighborhoods that might fit your aesthetic preferences and lifestyle. If you're one of those rare buyers-to-be who is not already obsessively house hunting, hop on Trulia and start regularly checking out homes and neighborhoods, making sure to take advantage of the neighborhood ratings and reviews feature, which empowers you to surface what other folks think and say about an area.

3. Rehab your credit, if you need to. Go to AnnualCreditReport.com and check out your credit reports - from all 3 bureaus - for free. (Note - these will not give you your credit score for free - that costs extra, but it will give you the actual detailed credit reports.) Audit them for errors and do the work of disputing inaccuracies to have them corrected. Pay particular attention to: accounts that are not yours/you never opened, derogatory information that should have "aged off" your report by now (i.e., 7 years for late payments, 10 for bankruptcies) and balances or credit limits that are inaccurate (i.e., your credit card balance is listed at $2500, but you actually only owe $250.) These are the errors most likely to foul up your financing, so follow the instructions each bureau provides to correct them, stat. While you're at it, don't close any accounts, even if you are able to pay some down or off - actually, check out these tips for getting the bank to give you the best possible home loan, without unintentionally making your score worse!

4. Run your numbers. In the past, some overextended homeowners complained that they felt pushed into a mortgage they couldn't afford. Pundits blamed that on the real estate and mortgage industry, but I have witnessed firsthand many a homebuyer push themselves or their spouses into buying too expensive of a home. Eliminate this issue entirely by doing this - run your own numbers, before you ever even talk to a salesperson or start looking at homes beyond your means. (I assure you, once you see the million dollar home you think you can afford, the $250,000 home you can actually afford will be underwhelming.)

Get your monthly finances in order, and get a clear read on how much your monthly bills are - outside of housing. Decide how much you can afford to spend every month for housing, when you buy your home. Get clear on exactly how much cash you plan to have at hand to put into your transaction up front. When, in the next step, you begin working with a mortgage broker, you'll want to share these numbers with them, early on in your conversation, to empower them to tell you what home price you can afford - not based on their rubrics, but based on what you say you want to spend every month and what you want to put down.

5. Talk to a real estate and mortgage broker (1 of each). Trulia is a great place to find an engaged, communicative, tech-savvy real estate broker or agent in your area. You can use our Find a Pro directory or simply start participating in the Trulia Voices Community, asking your questions and tagging them for the town where you plan to buy a home, and paying attention to the agents who give timely, thorough responses to your questions, and communicate in a language you understand.

Drop one (or a few) an email, letting them know you'd like to work on putting an action plan together for buying a home next year, and would like to talk with them about what action steps need to go on the list. Ask them to brief you on the timeline of a transaction in your local market, and to point out for you things like when along the process you'll need to bring money in, when you'll need to miss work and come into their office or the closing office, whether they offer conveniences like digital document signing, and generally the local standard practices about which buyers you'll need to know. Depending on your target home purchase timeline, they might even want you to take a spin with them and look at a few properties to reality-check your expectations or narrow down a broad wish list.

In addition to chatting with them about timing your purchase vis-à-vis your other life events and plans for the year, make sure to ask for referrals to a local, trustworthy mortgage broker or two - preferably one that has worked with them and closed a number of transactions with their clients. (In fact, many busy real estate pros will want you to talk with their trusty mortgage partner before they get too involved in your planning process. You may think you only need a month to get ready to buy, but once the mortgage folks weigh in, it might turn out that you actually need a few.) When you do get in touch with the mortgage maven, if you're serious about buying, you will want them to actually pull your credit report, check the actual FICO scores that come up on their system and give you their professional recommendations for what final tweaks you can do to your debts to get your credit score where it needs to be.

make smart decisions w/Tara's real estate + mortgage need-to-knows

Brought to you by Trulia.

There are lots of purchases that are highly prone to impulse buying: shoes on sale, puppies at the pound, and carrot cupcakes with cream cheese buttercream frosting come instantly to mind. (But that's just me.)

But houses? Not so much. Savvy, regret-free homebuying can take weeks or months of financial and lifestyle research and planning. If you want 2011 to be the year you become a homeowner, here are 5 things you should be doing, as we speak.

1. Minimize your holiday spending and save your cash. Instead of using the holiday sales to acquire a new winter wardrobe of cashmere sweaters, hold the discretionary spending down so you can give yourself the gift of homeownership! If you are serious about buying a home next year, don't run up additional credit card debt on gifts this year. Instead, make homemade cards or write holiday letters this year for everyone except the kiddos. And even for the kids, consider scaling back on the stuff, spending more of your time with them than your money, and getting started now saving toward your home purchase. (I don't think too many folks would argue that a less materialistic holiday season would hurt anyone, at any age.)

Kickstart your 2011 homebuying resolution by starting a "Home" savings account at an high-interest, online bank (the discipline-boosting goal is a bank that isn't super easy to transfer funds out of when you run low on cash), and set up an automatic deposit into it every payday. To get specific about your savings goal, if you're cash-flush, obviously a 20% down payment will get you top notch interest rates and provide you with the maximum ability to manage your monthly payments. If you're going to be more of a bootstrapping buyer, an FHA loan might be right up your alley - they offer a down payment of 3.5% of the purchase price.

All buyers should plan to have at least 3 percent of the purchase price saved up for closing costs, even if you want the seller to chip in. The lower-priced the home you want to buy, the more percentage points you should be willing to chip in for closing costs. It's easy for closing costs on an $150,000 FHA loan to run as high as $4,000 or more, considering transfer taxes, inspections, appraisals and mortgage insurance fees. So, even the scrappiest buyer should have a savings target somewhere around 6.5% of their target home's price. To buy a $200,000 home, for example, that would mean a savings target of $13,000.

Local real estate and mortgage pros can help you clarify realistic "cash to close" expectations and savings targets for your area - ask them, on Trulia Voices.

2. Research financing, areas homes, prices, agents and online. Smart homebuying takes a lot of research and knowledge-gathering. Since most buyers find it much harder to qualify for a mortgage than it is to find a home you'd love to live in, start with studying up on home financing and what it will take for you to get a home loan (note: FHA loans are preferred by the average homebuyer on today's market who has less than a 10% down payment, so start your research there).

If you're considering relocating next year, now's the time to start narrowing down states, cities and even neighborhoods that may or may not work for you. Take into account the job market, housing and other costs of living, and income and property tax rates, as well as the critical lifestyle inputs that vary from state-to-state, like weather and whether the place is a personality fit for you and the life you want to live, be it urban sophisticate or outdoors adventurer.

Also, start to develop a feel for home prices in a what-you-get-for-your-money type way, and start narrowing down the home styles and even neighborhoods that might fit your aesthetic preferences and lifestyle. If you're one of those rare buyers-to-be who is not already obsessively house hunting, hop on Trulia and start regularly checking out homes and neighborhoods, making sure to take advantage of the neighborhood ratings and reviews feature, which empowers you to surface what other folks think and say about an area.

3. Rehab your credit, if you need to. Go to AnnualCreditReport.com and check out your credit reports - from all 3 bureaus - for free. (Note - these will not give you your credit score for free - that costs extra, but it will give you the actual detailed credit reports.) Audit them for errors and do the work of disputing inaccuracies to have them corrected. Pay particular attention to: accounts that are not yours/you never opened, derogatory information that should have "aged off" your report by now (i.e., 7 years for late payments, 10 for bankruptcies) and balances or credit limits that are inaccurate (i.e., your credit card balance is listed at $2500, but you actually only owe $250.) These are the errors most likely to foul up your financing, so follow the instructions each bureau provides to correct them, stat. While you're at it, don't close any accounts, even if you are able to pay some down or off - actually, check out these tips for getting the bank to give you the best possible home loan, without unintentionally making your score worse!

4. Run your numbers. In the past, some overextended homeowners complained that they felt pushed into a mortgage they couldn't afford. Pundits blamed that on the real estate and mortgage industry, but I have witnessed firsthand many a homebuyer push themselves or their spouses into buying too expensive of a home. Eliminate this issue entirely by doing this - run your own numbers, before you ever even talk to a salesperson or start looking at homes beyond your means. (I assure you, once you see the million dollar home you think you can afford, the $250,000 home you can actually afford will be underwhelming.)

Get your monthly finances in order, and get a clear read on how much your monthly bills are - outside of housing. Decide how much you can afford to spend every month for housing, when you buy your home. Get clear on exactly how much cash you plan to have at hand to put into your transaction up front. When, in the next step, you begin working with a mortgage broker, you'll want to share these numbers with them, early on in your conversation, to empower them to tell you what home price you can afford - not based on their rubrics, but based on what you say you want to spend every month and what you want to put down.

5. Talk to a real estate and mortgage broker (1 of each). Trulia is a great place to find an engaged, communicative, tech-savvy real estate broker or agent in your area. You can use our Find a Pro directory or simply start participating in the Trulia Voices Community, asking your questions and tagging them for the town where you plan to buy a home, and paying attention to the agents who give timely, thorough responses to your questions, and communicate in a language you understand.

Drop one (or a few) an email, letting them know you'd like to work on putting an action plan together for buying a home next year, and would like to talk with them about what action steps need to go on the list. Ask them to brief you on the timeline of a transaction in your local market, and to point out for you things like when along the process you'll need to bring money in, when you'll need to miss work and come into their office or the closing office, whether they offer conveniences like digital document signing, and generally the local standard practices about which buyers you'll need to know. Depending on your target home purchase timeline, they might even want you to take a spin with them and look at a few properties to reality-check your expectations or narrow down a broad wish list.

In addition to chatting with them about timing your purchase vis-à-vis your other life events and plans for the year, make sure to ask for referrals to a local, trustworthy mortgage broker or two - preferably one that has worked with them and closed a number of transactions with their clients. (In fact, many busy real estate pros will want you to talk with their trusty mortgage partner before they get too involved in your planning process. You may think you only need a month to get ready to buy, but once the mortgage folks weigh in, it might turn out that you actually need a few.) When you do get in touch with the mortgage maven, if you're serious about buying, you will want them to actually pull your credit report, check the actual FICO scores that come up on their system and give you their professional recommendations for what final tweaks you can do to your debts to get your credit score where it needs to be.

Wednesday, December 8, 2010

Tuesday, December 7, 2010

December 2010: SAAB, REALTORS® Video Newsletter

Read and subscribe for Our Video News:

More Articles: "Why Buy a Home?";

"Disclosure: Safest Way To Sell A Home";

"Should I Take My Home Off the Market During the Holidays?";

"Tips for an Eco-Friendly Holiday";

"Value in Homeownership".

To view more news Selected by SAAB, REALTORS® click here.

More Articles: "Why Buy a Home?";

"Disclosure: Safest Way To Sell A Home";

"Should I Take My Home Off the Market During the Holidays?";

"Tips for an Eco-Friendly Holiday";

"Value in Homeownership".

To view more news Selected by SAAB, REALTORS® click here.

Subscribe to:

Posts (Atom)