Washington region posts gains as home prices still falling in most U.S. cities

By Dina ElBoghdady

Washington Post Staff Writer

Wednesday, December 29, 2010; 12:56 AM

The Washington region posted the highest year-over-year home price gains in the nation this fall, as real estate values slumped in nearly every other metropolitan area, a key housing report said Tuesday.

A healthy job market, particularly for high-salaried workers, buoyed demand and prices for housing in the D.C. area, local economists said. Home values climbed 3.7 percent in Washington in October from a year earlier, making it one of only four regions nationally to avoid a dip in prices, the Standard & Poor's Case-Shiller home-price index said.

read this article...

U.S. home prices drop 1.3% from September to October

By Dina ElBoghdady

Washington Post Staff Writer

Tuesday, December 28, 2010; 10:37 AM

Home prices fell in the nation's major metropolitan areas from September to October, with six regions hitting new lows, and they're not expected to rebound anytime soon.

The Standard & Poor's/Case-Shiller index, long considered a reliable gauge of the housing market's health, reported Tuesday that prices of single-family homes dropped 1.3 percent in all 20 regions it tracks.

The housing market's collapse crippled the economy, and a recovery in home prices is considered critical to getting the market back on track. But many economists predict that home prices will continue to fall into the new year and possibly beyond.

more from Washington Post.com, view video

SAAB REALTORS is the Washington DC Metropolitan Area premier real estate Solutions Company located in Vienna, VA. Our company specializes in foreclosure avoidance and is the foremost expert in this arena. SAAB REALTORS is a member of the Better Business Bureau and has been an integral part of the community for years. Call us today at 703.288.4877 and we can discuss your options!

Wednesday, December 29, 2010

Tuesday, December 28, 2010

Best Places to Live: Best places for the rich and single in 2010

We're not saying you're a gold digger. But you could follow the money to these 25 affluent cities, where singles are abundant.

Ranked #11. Arlington, VA

Population: 212,173

Single: 41.6%

Median family income: $104,452

Just a stone's throw from the nation's capital, Arlington is packed with Washington's movers and shakers, especially Department of Defense workers from the nearby Pentagon. Wind down with wonks at a pub on Wilson Boulevard. For a rowdier night, hit one of several live-music venues and comedy clubs -- or take to the dance floor at Clarendon Ballroom, which also boasts a rooftop bar. If you're more into the artsy scene, walk across the Roosevelt Bridge and catch a world-renowned music or theater performance at the Kennedy Center across the Potomac River. --H.Y.

read more...

Ranked #11. Arlington, VA

Population: 212,173

Single: 41.6%

Median family income: $104,452

Just a stone's throw from the nation's capital, Arlington is packed with Washington's movers and shakers, especially Department of Defense workers from the nearby Pentagon. Wind down with wonks at a pub on Wilson Boulevard. For a rowdier night, hit one of several live-music venues and comedy clubs -- or take to the dance floor at Clarendon Ballroom, which also boasts a rooftop bar. If you're more into the artsy scene, walk across the Roosevelt Bridge and catch a world-renowned music or theater performance at the Kennedy Center across the Potomac River. --H.Y.

read more...

Ranked #14. Towson, MD

Population: 52,301Single: 35.4% Median family income: $102,302

Do you think the brain is the sexiest part of the body? This small community near Baltimore boasts a significant population of professors as the home of Towson University and Goucher College, two of the biggest employers in the area. On Friday nights, academics loosen their bow ties and swing by Towson's Feet on the Street block parties featuring local bands. After the party winds down, crowds saunter down Allegheny Avenue, the town's main downtown strip, to local eateries and bars. --H.Y.

read more...

Do you think the brain is the sexiest part of the body? This small community near Baltimore boasts a significant population of professors as the home of Towson University and Goucher College, two of the biggest employers in the area. On Friday nights, academics loosen their bow ties and swing by Towson's Feet on the Street block parties featuring local bands. After the party winds down, crowds saunter down Allegheny Avenue, the town's main downtown strip, to local eateries and bars. --H.Y.

read more...

CNN MONEY: Best Places to Live in 2010 - Money's list of America's best small cities

And the winners are...

These terrific small cities -- even now -- boast plenty of jobs, great schools, safe streets, low crime, lots to do, charm, and other features that make a town great for raising a family.

read more...

Ranked #30. Centreville, VA

Population: 54,000

Compare Centreville to Top 10 Best Places

This historic town (it has some Civil War sites) is a close-knit suburban community with a great location.

This historic town (it has some Civil War sites) is a close-knit suburban community with a great location.

Ranked #47. Alexandria, VA

These terrific small cities -- even now -- boast plenty of jobs, great schools, safe streets, low crime, lots to do, charm, and other features that make a town great for raising a family.

| 1. Eden Prairie, MN 2. Columbia/Ellicott City, MD 3. Newton, MA 4. Bellevue, WA 5. McKinney, TX | 6. Fort Collins, CO 7. Overland Park, KS 8. Fishers, IN 9. Ames, IA 10. Rogers, AR |

Best Places to Live in 2010 : Top 100 - full list

Ranked 25. Gaithersburg, MD

Top 100 rank: 25

Population: 59,000

Compare Gaithersburg to Top 10 Best Places

Gaithersburg's ability to attract start-up companies has allowed it to rebound from the recession better than many other places. The town offers plenty of incubator-styled office space.

Large employers nearby include Northrop Grumman and Lockheed Martin.

Gaithersburg is just an hour's train ride to D.C. and hour car ride to downtown Baltimore, so residents can work in either town - and soak up the culture of both. --Najib Aminy

Ranked #30. Centreville, VA

Population: 54,000

Compare Centreville to Top 10 Best Places

This historic town (it has some Civil War sites) is a close-knit suburban community with a great location.

This historic town (it has some Civil War sites) is a close-knit suburban community with a great location. Washington, D.C., is anywhere from 40 minutes to an hour and a half away, depending on traffic. Centerville is also 20 minutes from Herndon, Tysons Corner, and Reston.

With major shopping centers nearby and the Bull Run Mountains an hour's drive away, Centerville lives up to its name. --N.A.

Ranked #47. Alexandria, VA

op 100 rank: 47

Population: 145,000

Compare Alexandria to Top 10 Best Places

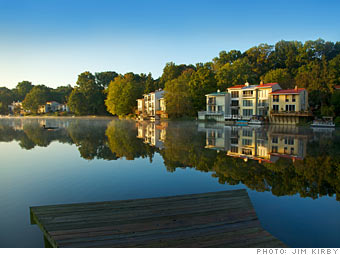

On the banks of the Potomac River, Alexandria offers a fusion of suburban and urban living that's just a stone's throw from the nation's capitol.

CNN Money: Top-earning towns 2010

Ranked #1. Bethesda, MD

Bethesda, Md., residents pull in more than $170,000 a year. Which other places in our Best Places database have high incomes?

Population: 56,763Median family income (per year): $172,541

Median home price: $725,000

There's a party for every season in this commuter town: Enjoy concerts and ice sculpting in the winter and Taste of Bethesda in October; schmooze with Pulitzer Prize winning authors at April's literary festival; and enjoy the strains of delta blues, soul and swing in the summer.

There's a party for every season in this commuter town: Enjoy concerts and ice sculpting in the winter and Taste of Bethesda in October; schmooze with Pulitzer Prize winning authors at April's literary festival; and enjoy the strains of delta blues, soul and swing in the summer. Year-round a dozen art galleries and hundreds of diverse restaurants woo suburbanites away from cul-de-sac comforts for days and nights downtown. An abundance of home fashion stores and graduate degrees (one in two residents has one) sets a swanky tone for this small community with big city style.

read more...

read more...

Ranked #9. Burke, VA

Population: 54,974

Median family income (per year): $127,036

Median home price: $335,000

This upscale community is a haven for government officials and federal contractors seeking a break from the capitol. But it also attracts residents who work for local businesses in nearby Arlington.The living is easy in this town, which puts shopping, pools, sports fields and footpaths within convenient reach. The prototypical suburb, it boasts great schools, high-end shops and well-tended footpaths.

This upscale community is a haven for government officials and federal contractors seeking a break from the capitol. But it also attracts residents who work for local businesses in nearby Arlington.The living is easy in this town, which puts shopping, pools, sports fields and footpaths within convenient reach. The prototypical suburb, it boasts great schools, high-end shops and well-tended footpaths.

Burke Centre Conservancy, a 1,700-acre planned residential community with 5 neighborhoods, pools and community centers is at the heart of it all.

read more...

Ranked # 16. Reston, VA

Median family income (per year): $127,036

Median home price: $335,000

This upscale community is a haven for government officials and federal contractors seeking a break from the capitol. But it also attracts residents who work for local businesses in nearby Arlington.

This upscale community is a haven for government officials and federal contractors seeking a break from the capitol. But it also attracts residents who work for local businesses in nearby Arlington.Burke Centre Conservancy, a 1,700-acre planned residential community with 5 neighborhoods, pools and community centers is at the heart of it all.

read more...

Ranked # 16. Reston, VA

Population: 58,718 Median family income (per year): $122,212

Median home price: $268,000

Neither a town nor a city, this unincorporated community has forged its identity since the mid-1960s when it first began wooing residents to its open air and neighborhood amenities.

Today it still stands apart with a special approach to governance. The Reston Association, a community service organization overseen by elected community members, maintains the high quality of life locals expect.

Environmental excellence has long been its claim to fame, but it pushed that distinction to new heights with the opening of Nature House, a LEED Gold certified year-round environmental education center.

read more...

Ranked #21. Ellicott City, MD

Median home price: $268,000

Neither a town nor a city, this unincorporated community has forged its identity since the mid-1960s when it first began wooing residents to its open air and neighborhood amenities.

Today it still stands apart with a special approach to governance. The Reston Association, a community service organization overseen by elected community members, maintains the high quality of life locals expect.

Environmental excellence has long been its claim to fame, but it pushed that distinction to new heights with the opening of Nature House, a LEED Gold certified year-round environmental education center.

read more...

Ranked #21. Ellicott City, MD

Population: 62,179

Median family income (per year): $116,820

Median home price: $380,000

From Art Deco to Victorian, this town's architecture is rich in tradition. Locals enjoy reveling in history, whether feasting on local cuisine at the Trolley Stop (originally built as a tavern in 1833) or trading ghost stories about residents of old who died in fires, floods and the Civil War.

From Art Deco to Victorian, this town's architecture is rich in tradition. Locals enjoy reveling in history, whether feasting on local cuisine at the Trolley Stop (originally built as a tavern in 1833) or trading ghost stories about residents of old who died in fires, floods and the Civil War.

Median family income (per year): $116,820

Median home price: $380,000

From Art Deco to Victorian, this town's architecture is rich in tradition. Locals enjoy reveling in history, whether feasting on local cuisine at the Trolley Stop (originally built as a tavern in 1833) or trading ghost stories about residents of old who died in fires, floods and the Civil War.

From Art Deco to Victorian, this town's architecture is rich in tradition. Locals enjoy reveling in history, whether feasting on local cuisine at the Trolley Stop (originally built as a tavern in 1833) or trading ghost stories about residents of old who died in fires, floods and the Civil War. Founded in 1772, Ellicott City lays claim to the oldest railroad terminus and operating flourmill in the country. With roots so deep, it's no surprise that its antique mall wins rave reviews too.

Real Estate News brought to you by CNN Money

• Welcome to Zombieland: Ladera Ranch, California • Foreclosure freeze coming • Should you gift your kid a down payment? • House hunters are too scared to buy despite low prices • Buy a foreclosure - save 30% on the price • Mortgage tax break in the crosshairs • Home prices fall 2% • Foreclosure scandal impact: Sales dry up • New home sales: Down 80% from the boom • Existing home sales slow down • Add 2.1 million houses to the glut • Improve your home for the holidays • Most (and least) affordable cities • Fewer homeowners behind on payments • It doesn't pay to remodel your home • Servicers must improve loan modifications, say state AGs • Foreclosure mess prompts call for stress tests • Canada's coming housing bust • Repossessions fall 9% in October • Home sales plummet 25% • Million-dollar homes: Massive discounts • Pay down the mortgage or save for retirement? • Homebuilders' survival lessons • Get a high-quality remodel for less • How one city dodged the recession • What the election means for foreclosures and robo-signing • Buy a wreck: 5 foreclosure specials • 3 ways low mortgage rates can work for you • American dream fades for more as homeownership falls | • Obama administration sings new tune on foreclosures • Home prices expected to slide another 8% • Foreclosure? Don't worry. You can still vote • Befuddled by foreclosures? • Australians swoop in on U.S. foreclosures • I was a robo-signer • Sin City is still foreclosure central • Wells Fargo to update foreclosure docs • New home sales in slow recovery • Google eyes purchase of massive NY building - report • Home prices sag • Obama mortgage mods dwindle • Existing home sales on the rise • Robo-signing: Just the start of bigger problems How to buy a foreclosure in a robo-signing world • We'd like to return these bad loans, please • Buy a foreclosure in a robo-signing world • What $1 million buys in a blighted neighborhood • Foreclosure mess: Fake signatures and lavish gifts • U.S. eyes criminal violations in foreclosure crisis • Illinois sheriff may halt evictions • You're not getting your house back • Foreclosure probe: Problems aren't 'systemic' • Housing mess: You can't stay if you don't pay • Housing starts hit 5-month high • Countrywide's Mozilo to pay $67.5 million settlement • Ohio AG to Ally: Stop foreclosure sales |

Home price plunge is widespread

10:46am: Prices drop in all 20 key cities in the S&P/Case-Shiller index, a sign that a double dip in housing is coming -- or has already arrived.

New home sales climb - but recovery is sluggish

Dec 23: New home sales edged higher in November, the government reported Thursday, but the recovery remains sluggish from a year ago.

Hooray? Higher mortgage rates spurred home sales uptick

Dec 23: The country's economic engine seems to be running in reverse as more expensive borrowing spurs home sales, and an uptick in borrowing sends mortgage rates back down. More

Home sales creep up - but are still off 30%

Dec 22: Existing home sales picked up steam in November but are still down nearly 30% from this time last year, an industry report said Tuesday.

America's most overvalued cities

Jan 27: Most markets were overvalued four years ago. No more. In the majority of markets now, homes sell at a discount to their fair market price.

more...

Buying a Home: Top things to know - brought to you by CNN Money

| 1. Don't buy if you can't stay put. 2. Start by shoring up your credit. 3. Aim for a home you can really afford. 4. If you can't put down the usual 20 percent, you may still qualify for a loan. 5. Buy in a district with good schools. | 6. Get professional help. 7. Choose carefully between points and rate. 8. Before house hunting, get pre-approved. 9. Do your homework before bidding. 10. Hire a home inspector. |

NEXT: Are you ready to own?

view article

Thursday, December 23, 2010

Make your own White House holiday decor

The Washington Post's Jura Koncius talks with the White House Chief Floral Designer about two holiday decorations that can be made at home. (Anna Uhls/The Washington Post)

click here...

Google Voice will have Santa call any of your friends...

Just for fun - Google Voice will have Santa call any of your friends and give them a custom message that includes their name and details about them. It's a fascinating use of technology - and a lot of fun. Check it out at SendACallFromSanta.com

Wednesday, December 15, 2010

Washington area is wealthiest and most educated region in the nation, census data show

Washington Post Staff Writers

Wednesday, December 15, 2010; 12:05 AM

During that period, Fairfax and Loudoun were the only two U.S. counties with median household incomes surpassing $100,000. Tiny Falls Church, which is an independent city and counted separately, had that median income level, as well. Five of the region's suburban counties - Fairfax, Arlington, Loudoun, Montgomery and Howard - plus Alexandria and Falls Church, were among 17 places in the United States in which more than half of the residents have at least a bachelor's degree.

In Loudoun, more than a third of the households are married couples with children, making it one of the country's bastions of the traditional family. The District, Baltimore and Richmond reflected the other extreme, with nuclear families making up fewer than one in 10 households.

The census data released Tuesday offer a more intimate glimpse of hundreds of the Washington region's neighborhoods than has been available. Among other things, the data will be used to provide a better understanding of segregation in the area and other U.S. communities.

The figures combine information gathered from 2005 to 2009 in the American Community Survey, a detailed questionnaire mailed monthly to a cross section of Americans.

read more...

Tuesday, December 14, 2010

U.S. foreclosure-prevention program fell short, Congressional Oversight Panel says

By Brady Dennis

Washington Post Staff Writer

Tuesday, December 14, 2010; 1:29 AM

The Treasury Department's primary foreclosure-prevention program has failed to live up to expectations and has suffered from a lack of "meaningful goals," according to a report from a congressional watchdog panel due out Tuesday.

The government's Home Affordable Modification Program, or HAMP, is on pace to prevent 700,000 to 800,000 foreclosures - a significant figure, but far fewer than the 3 million to 4 million struggling homeowners Treasury officials originally hoped to help, according to the bipartisan Congressional Oversight Panel.

"This has turned out to be a lot more complicated and a lot harder" than expected, the panel's chairman, Sen. Ted Kaufman (D-Del.), told reporters. He said he didn't consider HAMP a "failure" because it had helped many homeowners, but he added, "I think the program has just turned out to be smaller and has had a lot less impact" than anticipated.

read more...

Washington Post Staff Writer

Tuesday, December 14, 2010; 1:29 AM

The Treasury Department's primary foreclosure-prevention program has failed to live up to expectations and has suffered from a lack of "meaningful goals," according to a report from a congressional watchdog panel due out Tuesday.

The government's Home Affordable Modification Program, or HAMP, is on pace to prevent 700,000 to 800,000 foreclosures - a significant figure, but far fewer than the 3 million to 4 million struggling homeowners Treasury officials originally hoped to help, according to the bipartisan Congressional Oversight Panel.

"This has turned out to be a lot more complicated and a lot harder" than expected, the panel's chairman, Sen. Ted Kaufman (D-Del.), told reporters. He said he didn't consider HAMP a "failure" because it had helped many homeowners, but he added, "I think the program has just turned out to be smaller and has had a lot less impact" than anticipated.

read more...

Friday, December 10, 2010

Holiday Guide

Holiday decor at the White House

Click Here to view Holiday Guide

Gift Guides | Food & Entertaining | Fashion |

Activities | Seasonal Survival | Movie Guide

Gadget & Game Guide

Click Here to view Holiday Guide

Gift Guides | Food & Entertaining | Fashion |

Activities | Seasonal Survival | Movie Guide

Gadget & Game Guide

Housing agencies clash over mortgage-relief program

By Dina ElBoghdady and Zachary A. Goldfarb

Washington Post Staff Writers

Friday, December 10, 2010; 1:07 AM

The top federal agencies responsible for setting housing policy are clashing over a new program designed to help borrowers whose homes are worth less than they owe on their mortgages, according to industry and government sources.

The Federal Housing Administration says the program could avert foreclosures, but the Federal Housing Finance Agency has concerns that the program, if expanded to include the government-controlled mortgage giants Fannie Mae and Freddie Mac, could be a logistical nightmare that would cost taxpayers too much, the sources said.

About one in four borrowers is underwater. Without equity in their homes, these borrowers tend to be vulnerable to foreclosure because it is difficult for them to refinance or sell their homes. Housing advocates have said that helping these borrowers is important to stem the nation's foreclosure tide.

At issue is an FHA program launched in September that would allow some underwater borrowers who are current on their mortgages to refinance into more-affordable loans with a smaller loan balance and lower interest rate.

The agency, which answers to President Obama, says the program is an intelligent approach to avoid foreclosures among borrowers whose homes have substantially declined in value.

read more...

click here to watch video

Washington Post Staff Writers

Friday, December 10, 2010; 1:07 AM

The top federal agencies responsible for setting housing policy are clashing over a new program designed to help borrowers whose homes are worth less than they owe on their mortgages, according to industry and government sources.

The Federal Housing Administration says the program could avert foreclosures, but the Federal Housing Finance Agency has concerns that the program, if expanded to include the government-controlled mortgage giants Fannie Mae and Freddie Mac, could be a logistical nightmare that would cost taxpayers too much, the sources said.

About one in four borrowers is underwater. Without equity in their homes, these borrowers tend to be vulnerable to foreclosure because it is difficult for them to refinance or sell their homes. Housing advocates have said that helping these borrowers is important to stem the nation's foreclosure tide.

At issue is an FHA program launched in September that would allow some underwater borrowers who are current on their mortgages to refinance into more-affordable loans with a smaller loan balance and lower interest rate.

The agency, which answers to President Obama, says the program is an intelligent approach to avoid foreclosures among borrowers whose homes have substantially declined in value.

read more...

click here to watch video

Thursday, December 9, 2010

October 2010 Northern Virginia MarketWatch

October 2010 Real Estate Market Statistics for:

- Alexandria City, VA

- Arlington County, VA

- Fairfax City, VA

- Fairfax County, VA

- Falls Church City, VA

- Loudoun County, VA

- Manassas City, VA

- Manassas Park City, VA

- Prince William County, VA

5 Things to Do Now in Order to Buy a Home in 2011

Ask Tara @Trulia

make smart decisions w/Tara's real estate + mortgage need-to-knows

Brought to you by Trulia.

There are lots of purchases that are highly prone to impulse buying: shoes on sale, puppies at the pound, and carrot cupcakes with cream cheese buttercream frosting come instantly to mind. (But that's just me.)

But houses? Not so much. Savvy, regret-free homebuying can take weeks or months of financial and lifestyle research and planning. If you want 2011 to be the year you become a homeowner, here are 5 things you should be doing, as we speak.

1. Minimize your holiday spending and save your cash. Instead of using the holiday sales to acquire a new winter wardrobe of cashmere sweaters, hold the discretionary spending down so you can give yourself the gift of homeownership! If you are serious about buying a home next year, don't run up additional credit card debt on gifts this year. Instead, make homemade cards or write holiday letters this year for everyone except the kiddos. And even for the kids, consider scaling back on the stuff, spending more of your time with them than your money, and getting started now saving toward your home purchase. (I don't think too many folks would argue that a less materialistic holiday season would hurt anyone, at any age.)

Kickstart your 2011 homebuying resolution by starting a "Home" savings account at an high-interest, online bank (the discipline-boosting goal is a bank that isn't super easy to transfer funds out of when you run low on cash), and set up an automatic deposit into it every payday. To get specific about your savings goal, if you're cash-flush, obviously a 20% down payment will get you top notch interest rates and provide you with the maximum ability to manage your monthly payments. If you're going to be more of a bootstrapping buyer, an FHA loan might be right up your alley - they offer a down payment of 3.5% of the purchase price.

All buyers should plan to have at least 3 percent of the purchase price saved up for closing costs, even if you want the seller to chip in. The lower-priced the home you want to buy, the more percentage points you should be willing to chip in for closing costs. It's easy for closing costs on an $150,000 FHA loan to run as high as $4,000 or more, considering transfer taxes, inspections, appraisals and mortgage insurance fees. So, even the scrappiest buyer should have a savings target somewhere around 6.5% of their target home's price. To buy a $200,000 home, for example, that would mean a savings target of $13,000.

Local real estate and mortgage pros can help you clarify realistic "cash to close" expectations and savings targets for your area - ask them, on Trulia Voices.

2. Research financing, areas homes, prices, agents and online. Smart homebuying takes a lot of research and knowledge-gathering. Since most buyers find it much harder to qualify for a mortgage than it is to find a home you'd love to live in, start with studying up on home financing and what it will take for you to get a home loan (note: FHA loans are preferred by the average homebuyer on today's market who has less than a 10% down payment, so start your research there).

If you're considering relocating next year, now's the time to start narrowing down states, cities and even neighborhoods that may or may not work for you. Take into account the job market, housing and other costs of living, and income and property tax rates, as well as the critical lifestyle inputs that vary from state-to-state, like weather and whether the place is a personality fit for you and the life you want to live, be it urban sophisticate or outdoors adventurer.

Also, start to develop a feel for home prices in a what-you-get-for-your-money type way, and start narrowing down the home styles and even neighborhoods that might fit your aesthetic preferences and lifestyle. If you're one of those rare buyers-to-be who is not already obsessively house hunting, hop on Trulia and start regularly checking out homes and neighborhoods, making sure to take advantage of the neighborhood ratings and reviews feature, which empowers you to surface what other folks think and say about an area.

3. Rehab your credit, if you need to. Go to AnnualCreditReport.com and check out your credit reports - from all 3 bureaus - for free. (Note - these will not give you your credit score for free - that costs extra, but it will give you the actual detailed credit reports.) Audit them for errors and do the work of disputing inaccuracies to have them corrected. Pay particular attention to: accounts that are not yours/you never opened, derogatory information that should have "aged off" your report by now (i.e., 7 years for late payments, 10 for bankruptcies) and balances or credit limits that are inaccurate (i.e., your credit card balance is listed at $2500, but you actually only owe $250.) These are the errors most likely to foul up your financing, so follow the instructions each bureau provides to correct them, stat. While you're at it, don't close any accounts, even if you are able to pay some down or off - actually, check out these tips for getting the bank to give you the best possible home loan, without unintentionally making your score worse!

4. Run your numbers. In the past, some overextended homeowners complained that they felt pushed into a mortgage they couldn't afford. Pundits blamed that on the real estate and mortgage industry, but I have witnessed firsthand many a homebuyer push themselves or their spouses into buying too expensive of a home. Eliminate this issue entirely by doing this - run your own numbers, before you ever even talk to a salesperson or start looking at homes beyond your means. (I assure you, once you see the million dollar home you think you can afford, the $250,000 home you can actually afford will be underwhelming.)

Get your monthly finances in order, and get a clear read on how much your monthly bills are - outside of housing. Decide how much you can afford to spend every month for housing, when you buy your home. Get clear on exactly how much cash you plan to have at hand to put into your transaction up front. When, in the next step, you begin working with a mortgage broker, you'll want to share these numbers with them, early on in your conversation, to empower them to tell you what home price you can afford - not based on their rubrics, but based on what you say you want to spend every month and what you want to put down.

5. Talk to a real estate and mortgage broker (1 of each). Trulia is a great place to find an engaged, communicative, tech-savvy real estate broker or agent in your area. You can use our Find a Pro directory or simply start participating in the Trulia Voices Community, asking your questions and tagging them for the town where you plan to buy a home, and paying attention to the agents who give timely, thorough responses to your questions, and communicate in a language you understand.

Drop one (or a few) an email, letting them know you'd like to work on putting an action plan together for buying a home next year, and would like to talk with them about what action steps need to go on the list. Ask them to brief you on the timeline of a transaction in your local market, and to point out for you things like when along the process you'll need to bring money in, when you'll need to miss work and come into their office or the closing office, whether they offer conveniences like digital document signing, and generally the local standard practices about which buyers you'll need to know. Depending on your target home purchase timeline, they might even want you to take a spin with them and look at a few properties to reality-check your expectations or narrow down a broad wish list.

In addition to chatting with them about timing your purchase vis-à-vis your other life events and plans for the year, make sure to ask for referrals to a local, trustworthy mortgage broker or two - preferably one that has worked with them and closed a number of transactions with their clients. (In fact, many busy real estate pros will want you to talk with their trusty mortgage partner before they get too involved in your planning process. You may think you only need a month to get ready to buy, but once the mortgage folks weigh in, it might turn out that you actually need a few.) When you do get in touch with the mortgage maven, if you're serious about buying, you will want them to actually pull your credit report, check the actual FICO scores that come up on their system and give you their professional recommendations for what final tweaks you can do to your debts to get your credit score where it needs to be.

make smart decisions w/Tara's real estate + mortgage need-to-knows

Brought to you by Trulia.

There are lots of purchases that are highly prone to impulse buying: shoes on sale, puppies at the pound, and carrot cupcakes with cream cheese buttercream frosting come instantly to mind. (But that's just me.)

But houses? Not so much. Savvy, regret-free homebuying can take weeks or months of financial and lifestyle research and planning. If you want 2011 to be the year you become a homeowner, here are 5 things you should be doing, as we speak.

1. Minimize your holiday spending and save your cash. Instead of using the holiday sales to acquire a new winter wardrobe of cashmere sweaters, hold the discretionary spending down so you can give yourself the gift of homeownership! If you are serious about buying a home next year, don't run up additional credit card debt on gifts this year. Instead, make homemade cards or write holiday letters this year for everyone except the kiddos. And even for the kids, consider scaling back on the stuff, spending more of your time with them than your money, and getting started now saving toward your home purchase. (I don't think too many folks would argue that a less materialistic holiday season would hurt anyone, at any age.)

Kickstart your 2011 homebuying resolution by starting a "Home" savings account at an high-interest, online bank (the discipline-boosting goal is a bank that isn't super easy to transfer funds out of when you run low on cash), and set up an automatic deposit into it every payday. To get specific about your savings goal, if you're cash-flush, obviously a 20% down payment will get you top notch interest rates and provide you with the maximum ability to manage your monthly payments. If you're going to be more of a bootstrapping buyer, an FHA loan might be right up your alley - they offer a down payment of 3.5% of the purchase price.

All buyers should plan to have at least 3 percent of the purchase price saved up for closing costs, even if you want the seller to chip in. The lower-priced the home you want to buy, the more percentage points you should be willing to chip in for closing costs. It's easy for closing costs on an $150,000 FHA loan to run as high as $4,000 or more, considering transfer taxes, inspections, appraisals and mortgage insurance fees. So, even the scrappiest buyer should have a savings target somewhere around 6.5% of their target home's price. To buy a $200,000 home, for example, that would mean a savings target of $13,000.

Local real estate and mortgage pros can help you clarify realistic "cash to close" expectations and savings targets for your area - ask them, on Trulia Voices.

2. Research financing, areas homes, prices, agents and online. Smart homebuying takes a lot of research and knowledge-gathering. Since most buyers find it much harder to qualify for a mortgage than it is to find a home you'd love to live in, start with studying up on home financing and what it will take for you to get a home loan (note: FHA loans are preferred by the average homebuyer on today's market who has less than a 10% down payment, so start your research there).

If you're considering relocating next year, now's the time to start narrowing down states, cities and even neighborhoods that may or may not work for you. Take into account the job market, housing and other costs of living, and income and property tax rates, as well as the critical lifestyle inputs that vary from state-to-state, like weather and whether the place is a personality fit for you and the life you want to live, be it urban sophisticate or outdoors adventurer.

Also, start to develop a feel for home prices in a what-you-get-for-your-money type way, and start narrowing down the home styles and even neighborhoods that might fit your aesthetic preferences and lifestyle. If you're one of those rare buyers-to-be who is not already obsessively house hunting, hop on Trulia and start regularly checking out homes and neighborhoods, making sure to take advantage of the neighborhood ratings and reviews feature, which empowers you to surface what other folks think and say about an area.

3. Rehab your credit, if you need to. Go to AnnualCreditReport.com and check out your credit reports - from all 3 bureaus - for free. (Note - these will not give you your credit score for free - that costs extra, but it will give you the actual detailed credit reports.) Audit them for errors and do the work of disputing inaccuracies to have them corrected. Pay particular attention to: accounts that are not yours/you never opened, derogatory information that should have "aged off" your report by now (i.e., 7 years for late payments, 10 for bankruptcies) and balances or credit limits that are inaccurate (i.e., your credit card balance is listed at $2500, but you actually only owe $250.) These are the errors most likely to foul up your financing, so follow the instructions each bureau provides to correct them, stat. While you're at it, don't close any accounts, even if you are able to pay some down or off - actually, check out these tips for getting the bank to give you the best possible home loan, without unintentionally making your score worse!

4. Run your numbers. In the past, some overextended homeowners complained that they felt pushed into a mortgage they couldn't afford. Pundits blamed that on the real estate and mortgage industry, but I have witnessed firsthand many a homebuyer push themselves or their spouses into buying too expensive of a home. Eliminate this issue entirely by doing this - run your own numbers, before you ever even talk to a salesperson or start looking at homes beyond your means. (I assure you, once you see the million dollar home you think you can afford, the $250,000 home you can actually afford will be underwhelming.)

Get your monthly finances in order, and get a clear read on how much your monthly bills are - outside of housing. Decide how much you can afford to spend every month for housing, when you buy your home. Get clear on exactly how much cash you plan to have at hand to put into your transaction up front. When, in the next step, you begin working with a mortgage broker, you'll want to share these numbers with them, early on in your conversation, to empower them to tell you what home price you can afford - not based on their rubrics, but based on what you say you want to spend every month and what you want to put down.

5. Talk to a real estate and mortgage broker (1 of each). Trulia is a great place to find an engaged, communicative, tech-savvy real estate broker or agent in your area. You can use our Find a Pro directory or simply start participating in the Trulia Voices Community, asking your questions and tagging them for the town where you plan to buy a home, and paying attention to the agents who give timely, thorough responses to your questions, and communicate in a language you understand.

Drop one (or a few) an email, letting them know you'd like to work on putting an action plan together for buying a home next year, and would like to talk with them about what action steps need to go on the list. Ask them to brief you on the timeline of a transaction in your local market, and to point out for you things like when along the process you'll need to bring money in, when you'll need to miss work and come into their office or the closing office, whether they offer conveniences like digital document signing, and generally the local standard practices about which buyers you'll need to know. Depending on your target home purchase timeline, they might even want you to take a spin with them and look at a few properties to reality-check your expectations or narrow down a broad wish list.

In addition to chatting with them about timing your purchase vis-à-vis your other life events and plans for the year, make sure to ask for referrals to a local, trustworthy mortgage broker or two - preferably one that has worked with them and closed a number of transactions with their clients. (In fact, many busy real estate pros will want you to talk with their trusty mortgage partner before they get too involved in your planning process. You may think you only need a month to get ready to buy, but once the mortgage folks weigh in, it might turn out that you actually need a few.) When you do get in touch with the mortgage maven, if you're serious about buying, you will want them to actually pull your credit report, check the actual FICO scores that come up on their system and give you their professional recommendations for what final tweaks you can do to your debts to get your credit score where it needs to be.

Wednesday, December 8, 2010

Tuesday, December 7, 2010

December 2010: SAAB, REALTORS® Video Newsletter

Read and subscribe for Our Video News:

More Articles: "Why Buy a Home?";

"Disclosure: Safest Way To Sell A Home";

"Should I Take My Home Off the Market During the Holidays?";

"Tips for an Eco-Friendly Holiday";

"Value in Homeownership".

To view more news Selected by SAAB, REALTORS® click here.

More Articles: "Why Buy a Home?";

"Disclosure: Safest Way To Sell A Home";

"Should I Take My Home Off the Market During the Holidays?";

"Tips for an Eco-Friendly Holiday";

"Value in Homeownership".

To view more news Selected by SAAB, REALTORS® click here.

Wednesday, November 17, 2010

States, mortgage lenders in talks over fund for borrowers in foreclosure mess

By Ariana Eunjung Cha and Brady Dennis

Washington Post Staff Writers

Wednesday, November 17, 2010; 12:03 AM

State attorneys general and the country's biggest lenders are negotiating to create a nationwide fund to compensate borrowers who can prove they lost their home in an improper foreclosure, state and industry officials said.

This Story

States, mortgage lenders in talks over fund for borrowers in foreclosure mess

Liu Calls for Independent Audit of Foreclosure Practices

Don't underestimate foreclosure crisis, watchdog warns

Foreclosure Nation

Full coverage: Foreclosure system in chaos

Q and A: Head of probe says victims of wrongful foreclosure should get compensation

View All Items in This Story

View Only Top Items in This Story

The fund would present a solution for both sides, helping banks avoid lengthy and costly court challenges from homeowners and aiding state investigators in their efforts to seek relief for homeowners who were wronged, the officials said.

more...

Launch Video

Washington Post Staff Writers

Wednesday, November 17, 2010; 12:03 AM

State attorneys general and the country's biggest lenders are negotiating to create a nationwide fund to compensate borrowers who can prove they lost their home in an improper foreclosure, state and industry officials said.

This Story

States, mortgage lenders in talks over fund for borrowers in foreclosure mess

Liu Calls for Independent Audit of Foreclosure Practices

Don't underestimate foreclosure crisis, watchdog warns

Foreclosure Nation

Full coverage: Foreclosure system in chaos

Q and A: Head of probe says victims of wrongful foreclosure should get compensation

View All Items in This Story

View Only Top Items in This Story

The fund would present a solution for both sides, helping banks avoid lengthy and costly court challenges from homeowners and aiding state investigators in their efforts to seek relief for homeowners who were wronged, the officials said.

more...

Launch Video

Tuesday, November 16, 2010

Top News: week of November 15th, 2010

Don't underestimate foreclosure crisis, watchdog to warn

By Brady Dennis and Ariana Eunjung Cha

Washington Post Staff Writers

Tuesday, November 16, 2010; 12:09 AM

A congressional oversight panel is set to warn on Tuesday that a widespread problem of flawed and fraudulent foreclosure paperwork could upend the housing market and undermine the nation's financial stability, just as the issue is coming under greater scrutiny this week in Washington.

The report, issued by the Congressional Oversight Panel, which monitors the government's bailout program, marks the first time a federal watchdog has weighed in on the nationwide foreclosure mess.

The panel echoed concerns raised by consumer advocates and financial analysts, who have said that although the consequences of the foreclosure debacle remain unclear, the problems could throw into doubt the ownership not only of foreclosed properties but also the millions of ordinary mortgages that were pooled and traded by investors around the world.

more...

FHA's cash reserves rebounding, audit shows

By Dina ElBoghdady

Washington Post Staff Writer

Tuesday, November 16, 2010; 12:08 AM

The Federal Housing Administration's cash reserves remain below the level required by law, but they have not deteriorated much since last year and taxpayer funding will not be necessary to buoy the agency even under worst-case scenarios, federal officials said Monday.

The officials cited an independent audit, due to be released Tuesday, that examined the excess cash the agency must set aside to deal with unexpected losses in its flagship home-buying program. That program has played a critical role in propping up the housing market and currently supports one in five home purchases nationwide.

As of Sept. 30, the agency's reserves had an estimated value of $4.7 billion, up from $3.6 billion a year earlier. The current total represents 0.5 percent of all outstanding single-family home loans insured by the FHA, compared with 0.53 percent a year earlier. The margin narrowed from the previous fiscal year because the agency is insuring more loans.

more...

By Brady Dennis and Ariana Eunjung Cha

Washington Post Staff Writers

Tuesday, November 16, 2010; 12:09 AM

A congressional oversight panel is set to warn on Tuesday that a widespread problem of flawed and fraudulent foreclosure paperwork could upend the housing market and undermine the nation's financial stability, just as the issue is coming under greater scrutiny this week in Washington.

The report, issued by the Congressional Oversight Panel, which monitors the government's bailout program, marks the first time a federal watchdog has weighed in on the nationwide foreclosure mess.

The panel echoed concerns raised by consumer advocates and financial analysts, who have said that although the consequences of the foreclosure debacle remain unclear, the problems could throw into doubt the ownership not only of foreclosed properties but also the millions of ordinary mortgages that were pooled and traded by investors around the world.

more...

FHA's cash reserves rebounding, audit shows

By Dina ElBoghdady

Washington Post Staff Writer

Tuesday, November 16, 2010; 12:08 AM

The Federal Housing Administration's cash reserves remain below the level required by law, but they have not deteriorated much since last year and taxpayer funding will not be necessary to buoy the agency even under worst-case scenarios, federal officials said Monday.

The officials cited an independent audit, due to be released Tuesday, that examined the excess cash the agency must set aside to deal with unexpected losses in its flagship home-buying program. That program has played a critical role in propping up the housing market and currently supports one in five home purchases nationwide.

As of Sept. 30, the agency's reserves had an estimated value of $4.7 billion, up from $3.6 billion a year earlier. The current total represents 0.5 percent of all outstanding single-family home loans insured by the FHA, compared with 0.53 percent a year earlier. The margin narrowed from the previous fiscal year because the agency is insuring more loans.

more...

Wednesday, November 10, 2010

Friday, November 5, 2010

Stocks soar after Federal Reserve's move to bolster U.S. economy

By Neil Irwin and Lori Montgomery

Washington Post Staff Writers

Friday, November 5, 2010; 12:37 AM

The Federal Reserve's aggressive action this week to boost the economy sent stocks soaring Thursday to their highest level in two years as investors expressed renewed confidence that someone in Washington was finally giving the sluggish recovery a lift.

The Dow Jones industrial average was up nearly 2 percent, erasing the last of the breathtaking losses that followed the failure of the investment bank Lehman Brothers in September 2008 and the resulting panic over a possible collapse of the global financial system. Other major U.S. stock indexes were also up sharply.

The Fed's decision to pump $600 billion into the economy through a massive program of Treasury bond purchases was a dramatic move at a time when the White House and Congress have been unable to muster a coherent policy for fueling the recovery and reducing a stubbornly high jobless rate.

more...

watch video

Washington Post Staff Writers

Friday, November 5, 2010; 12:37 AM

The Federal Reserve's aggressive action this week to boost the economy sent stocks soaring Thursday to their highest level in two years as investors expressed renewed confidence that someone in Washington was finally giving the sluggish recovery a lift.

The Dow Jones industrial average was up nearly 2 percent, erasing the last of the breathtaking losses that followed the failure of the investment bank Lehman Brothers in September 2008 and the resulting panic over a possible collapse of the global financial system. Other major U.S. stock indexes were also up sharply.

The Fed's decision to pump $600 billion into the economy through a massive program of Treasury bond purchases was a dramatic move at a time when the White House and Congress have been unable to muster a coherent policy for fueling the recovery and reducing a stubbornly high jobless rate.

more...

watch video

Thursday, November 4, 2010

Area unemployment drops in Sept. after private-sector job gains

By V. Dion Haynes

Washington Post Staff Writer

Thursday, November 4, 2010; 12:03 AM

The Washington area led the nation in employment growth with 56,000 new jobs created over the 12-month period that ended in September, according to federal government data released Wednesday.

watch video

more...

Washington Post Staff Writer

Thursday, November 4, 2010; 12:03 AM

The Washington area led the nation in employment growth with 56,000 new jobs created over the 12-month period that ended in September, according to federal government data released Wednesday.

watch video

more...

Fed to buy $600 billion in bonds in effort to boost economic recovery

By Neil Irwin

Washington Post Staff Writer

Thursday, November 4, 2010; 12:31 AM

The Federal Reserve escalated its efforts to get the U.S. economic recovery back on track Wednesday, again entering the realm of risky and untested policy in response to the worst downturn in generations.

The plan to pump $600 billion into the financial system is designed to stimulate the economy in large part by lowering mortgage and other interest rates.

more...

Washington Post Staff Writer

Thursday, November 4, 2010; 12:31 AM

The Federal Reserve escalated its efforts to get the U.S. economic recovery back on track Wednesday, again entering the realm of risky and untested policy in response to the worst downturn in generations.

The plan to pump $600 billion into the financial system is designed to stimulate the economy in large part by lowering mortgage and other interest rates.

more...

Monday, October 25, 2010

September jobless rates down in D.C. and Virginia, up in Maryland

By V. Dion Haynes

Washington Post Staff Writer

Saturday, October 23, 2010; 3:03 AM

Unemployment rates in September dropped in the District and Virginia but rose by 0.2 percentage points in Maryland, according to federal government data released Friday. The numbers illustrate long-term improvement in the regional job market but prolonged reluctance among employers to significantly expand their payrolls because of lingering uncertainty about the economy.

Maryland's rate jumped to 7.5 percent from 7.3 percent in August, according to Bureau of Labor Statistics data. The rates fell by 0.1 points to 9.8 percent in the District and to 6.8 percent in Virginia. The U.S. unemployment rate in September remained steady at 9.6 percent.

"This has just been a very tenuous time," said Ann D. Lang, senior economist at the Virginia Employment Commission. "Retail sales rose in September - there's some spending going on," but employers are "holding back a little and concerned about jobs and if we're going to get on a solid road here." more...

Washington Post Staff Writer

Saturday, October 23, 2010; 3:03 AM

Unemployment rates in September dropped in the District and Virginia but rose by 0.2 percentage points in Maryland, according to federal government data released Friday. The numbers illustrate long-term improvement in the regional job market but prolonged reluctance among employers to significantly expand their payrolls because of lingering uncertainty about the economy.

Maryland's rate jumped to 7.5 percent from 7.3 percent in August, according to Bureau of Labor Statistics data. The rates fell by 0.1 points to 9.8 percent in the District and to 6.8 percent in Virginia. The U.S. unemployment rate in September remained steady at 9.6 percent.

"This has just been a very tenuous time," said Ann D. Lang, senior economist at the Virginia Employment Commission. "Retail sales rose in September - there's some spending going on," but employers are "holding back a little and concerned about jobs and if we're going to get on a solid road here." more...

Friday, October 22, 2010

Fannie Mae, Freddie Mac bailout cost is likely to rise to $154 billion, agency projects

By Zachary A. Goldfarb

Washington Post Staff Writer

Friday, October 22, 2010; 12:13 AM

The bailout of Fannie Mae and Freddie Mac is likely to cost taxpayers an additional $19 billion and may cost as much as $124 billion more if the economy starts shrinking again, according to a government projection released Thursday. The rescue of the mortgage giants, which has helped keep the housing market alive amid economic crisis and recession, already has a price tag of $135 billion. The money went to cover losses on defaulted home loans.

The ballooning price of the Fannie and Freddie bailout comes as the Obama administration celebrates news of lower costs on other financial rescues. Administration officials are also preparing to release a plan for reforming the two companies in coming months.

more...

Watch Video

Washington Post Staff Writer

Friday, October 22, 2010; 12:13 AM

The bailout of Fannie Mae and Freddie Mac is likely to cost taxpayers an additional $19 billion and may cost as much as $124 billion more if the economy starts shrinking again, according to a government projection released Thursday. The rescue of the mortgage giants, which has helped keep the housing market alive amid economic crisis and recession, already has a price tag of $135 billion. The money went to cover losses on defaulted home loans.

The ballooning price of the Fannie and Freddie bailout comes as the Obama administration celebrates news of lower costs on other financial rescues. Administration officials are also preparing to release a plan for reforming the two companies in coming months.

more...

Watch Video

Lawyers got it right on the foreclosure mess

By Eugene Robinson

Friday, October 22, 2010

Don't blame the lawyers. The crisis over faulty or fraudulent paperwork in mortgage foreclosures -- which is either a big deal or a humongous deal, depending on which experts you believe -- is the fault of arrogant, greedy lenders who played fast and loose with the basic property rights of homeowners.

Friday, October 22, 2010

Don't blame the lawyers. The crisis over faulty or fraudulent paperwork in mortgage foreclosures -- which is either a big deal or a humongous deal, depending on which experts you believe -- is the fault of arrogant, greedy lenders who played fast and loose with the basic property rights of homeowners.

Banks and other lenders, it seems, made statements in courts of law that turned out not to be true. Because judges have such an underdeveloped sense of humor when it comes to prevarication, this mess may be with us for a while.

more...Thursday, October 21, 2010

Fannie, Freddie bailout could double, regulator says

By Zachary A. Goldfarb

Washington Post Staff Writer

Thursday, October 21, 2010; 11:53 AM

The federal bailout for Fannie Mae and Freddie Mac could double in size during the next three years, according to projections from the companies' federal regulator.

Fannie and Freddie, the federally controlled mortgage finance giants, probably will need at least another $73 billion and perhaps as much as $215 billion from taxpayers in the next three years to meet their financial obligations, the Federal Housing Finance Agency said, but much of that money would automatically be returned to the government.

The growing taxpayer infusions will cover losses Fannie and Freddie suffer on home loans, as well as payments the companies must make to the U.S. Treasury in exchange for a federal guarantee to provide cash to keep the companies solvent. more...

Gardner Doesn't Sees Fannie, Freddie Overhaul Until 2013: Video

Washington Post Staff Writer

Thursday, October 21, 2010; 11:53 AM

The federal bailout for Fannie Mae and Freddie Mac could double in size during the next three years, according to projections from the companies' federal regulator.

Fannie and Freddie, the federally controlled mortgage finance giants, probably will need at least another $73 billion and perhaps as much as $215 billion from taxpayers in the next three years to meet their financial obligations, the Federal Housing Finance Agency said, but much of that money would automatically be returned to the government.

The growing taxpayer infusions will cover losses Fannie and Freddie suffer on home loans, as well as payments the companies must make to the U.S. Treasury in exchange for a federal guarantee to provide cash to keep the companies solvent. more...

Gardner Doesn't Sees Fannie, Freddie Overhaul Until 2013: Video

Wednesday, October 20, 2010

Task force probing whether banks broke federal laws during home seizures

By Zachary A. Goldfarb

Washington Post Staff Writer

Wednesday, October 20, 2010; 12:11 AM

Federal investigators are exploring whether banks and other financial firms broke U.S. law when using fraudulent court documents to foreclose on people's homes, according to sources familiar with the effort.

The criminal investigation, still in its early days, is focused on whether companies misled federal housing agencies that now insure a large share of U.S. home loans, and whether the firms committed wire or mail fraud in filing false paperwork.

Although prosecutors across the country previously opened a patchwork of inquiries, a broader federal effort targeting companies that improperly evicted people from their homes is only now taking shape. This comes at the same time that investors have begun to hold firms accountable for selling securities composed of mortgages that were improperly serviced.

more...

Thousands of Foreclosures are put on hold. Click here to Watch the Video.

Washington Post Staff Writer

Wednesday, October 20, 2010; 12:11 AM

Federal investigators are exploring whether banks and other financial firms broke U.S. law when using fraudulent court documents to foreclose on people's homes, according to sources familiar with the effort.

The criminal investigation, still in its early days, is focused on whether companies misled federal housing agencies that now insure a large share of U.S. home loans, and whether the firms committed wire or mail fraud in filing false paperwork.

Although prosecutors across the country previously opened a patchwork of inquiries, a broader federal effort targeting companies that improperly evicted people from their homes is only now taking shape. This comes at the same time that investors have begun to hold firms accountable for selling securities composed of mortgages that were improperly serviced.

more...

Thousands of Foreclosures are put on hold. Click here to Watch the Video.

Tuesday, October 19, 2010

Foreclosure freeze leads to uneasy politics for Democrats

By Steven Mufson

Washington Post Staff Writer

Tuesday, October 19, 2010; 7:26 AM

The details of the foreclosure mess are ugly and complicated. The politics of it are even worse.

The calculus is clear for most Democratic incumbents, especially those in tight races like Senate Majority Leader Harry M. Reid: Nothing could be worse on the eve of elections than images of people being booted out of their homes by big banks that have relied on sloppy, if not fraudulent, paperwork.

But reviving the economy requires repairing the housing market, which won't happen until foreclosed properties and delinquent mortgages are dealt with. So the White House, which is looking past the midterm elections, has been restrained. Housing and Urban Development Secretary Shaun Donovan wrote over the weekend that "a national, blanket moratorium on all foreclosure sales would do far more harm than good, hurting homeowners and home buyers alike."

more...

Washington Post Staff Writer

Tuesday, October 19, 2010; 7:26 AM

The details of the foreclosure mess are ugly and complicated. The politics of it are even worse.

The calculus is clear for most Democratic incumbents, especially those in tight races like Senate Majority Leader Harry M. Reid: Nothing could be worse on the eve of elections than images of people being booted out of their homes by big banks that have relied on sloppy, if not fraudulent, paperwork.

But reviving the economy requires repairing the housing market, which won't happen until foreclosed properties and delinquent mortgages are dealt with. So the White House, which is looking past the midterm elections, has been restrained. Housing and Urban Development Secretary Shaun Donovan wrote over the weekend that "a national, blanket moratorium on all foreclosure sales would do far more harm than good, hurting homeowners and home buyers alike."

more...

Whalen Calls U.S. Foreclosure Crisis a `Cancer': Video

Watch this Video:Thursday, October 14, 2010

U.S. presses mortgage lenders to fix documents, but foreclosures can continue

By Zachary A. Goldfarb,Dina ElBoghdady and Ariana Eunjung Cha

Washington Post Staff Writers

Thursday, October 14, 2010; 12:31 AM

Federal regulators sought Wednesday to prevent the growing furor over improper foreclosures from escalating, pressing mortgage lenders to replace flawed and fraudulent court documents while insisting that foreclosures continue apace. more...

see video

Washington Post Staff Writers

Thursday, October 14, 2010; 12:31 AM

Federal regulators sought Wednesday to prevent the growing furor over improper foreclosures from escalating, pressing mortgage lenders to replace flawed and fraudulent court documents while insisting that foreclosures continue apace. more...

see video

Housing troubles face new Pr. George's county executive

By Ovetta Wiggins

Washington Post Staff Writer

Thursday, October 14, 2010

Less than a year after Prince George's County lost millions in federal housing aid, a report is calling on the next county executive to revamp the housing department by conducting a national search for a director, setting up a local trust fund for housing needs and offering more rental housing. more...

Washington Post Staff Writer

Thursday, October 14, 2010

Less than a year after Prince George's County lost millions in federal housing aid, a report is calling on the next county executive to revamp the housing department by conducting a national search for a director, setting up a local trust fund for housing needs and offering more rental housing. more...

Tuesday, October 12, 2010

Financial regulators planning worldwide rules for large firms

By Howard Schneider

Washington Post Staff Writer

Sunday, October 10, 2010; 9:09 PM

International bank regulators are planning a fresh wave of rules for the world's most important financial companies in an effort to ensure that firms considered "too big to fail" are better protected from collapse - and that taxpayers are insulated from the fallout if they do. more...

Washington Post Staff Writer

Sunday, October 10, 2010; 9:09 PM

International bank regulators are planning a fresh wave of rules for the world's most important financial companies in an effort to ensure that firms considered "too big to fail" are better protected from collapse - and that taxpayers are insulated from the fallout if they do. more...

Friday, October 8, 2010

Reston-based company MERS in the middle of foreclosure chaos

By Brady Dennis and Ariana Eunjung Cha

Washington Post Staff Writers

Friday, October 8, 2010; 12:01 AM

As courts across the country face a wave of foreclosures, a name little known to the public has cropped up on thousands of court filings as a stand-in for prominent banks, lenders and mortgage servicers. more...

Washington Post Staff Writers

Friday, October 8, 2010; 12:01 AM

As courts across the country face a wave of foreclosures, a name little known to the public has cropped up on thousands of court filings as a stand-in for prominent banks, lenders and mortgage servicers. more...

Monday, October 4, 2010

Top Real Estate Updates: Week of September 4th, 2010

Home prices up, but growth rate slows

U.S. home prices

Case-Shiller Index, US House Prices, (2000 = 100)

By Les Christie, staff writerSeptember 28, 2010: 10:38 AM ET

NEW YORK (CNNMoney.com) -- Home prices have risen for five straight months, but the rate of growth has slowed, according to an industry report released Tuesday.

Prices inched up 0.6% in July compared with June, according to S&P/Case-Shiller 20-city home price index. On a year-over-year basis, prices rose 3.2% compared with July 2009. more...

Mortgages under 5% are back in bloom

With one of the key measures below the benchmark for the second week in a row, would-be home buyers face the best rates since the spring.

By Julianne Pepitone, CNNMoney.com staff reporter

Last Updated: October 8, 2009: 1:03 PM ET

NEW YORK (CNNMoney.com) -- The possibility of securing a mortgage rate below 5% has greatly improved in recent weeks, in a positive sign for would-be home buyers.

Home mortgage rates fell for the sixth straight week, according to two key measures, with one of them pointing to a sub-5% rate for the 30-year fixed loan for the second week in a row. more...

The powers (of attorney) that be: What you need to know now

By Harvey S. Jacobs

Special to The Washington Post

Saturday, October 2, 2010

On Oct. 1, the Maryland General and Limited Power of Attorney Act took effect. The changes make it more difficult to delegate a power of attorney, and so this tool can no longer be regarded as a last-minute alternative to attending a real estate closing.

Dubbed "Loretta's Law," the measure was partially the result of one family member abusing the power entrusted to her by her elderly aunt. more...

U.S. home prices

Case-Shiller Index, US House Prices, (2000 = 100)

By Les Christie, staff writerSeptember 28, 2010: 10:38 AM ET

NEW YORK (CNNMoney.com) -- Home prices have risen for five straight months, but the rate of growth has slowed, according to an industry report released Tuesday.

Prices inched up 0.6% in July compared with June, according to S&P/Case-Shiller 20-city home price index. On a year-over-year basis, prices rose 3.2% compared with July 2009. more...

Mortgages under 5% are back in bloom

With one of the key measures below the benchmark for the second week in a row, would-be home buyers face the best rates since the spring.

By Julianne Pepitone, CNNMoney.com staff reporter

Last Updated: October 8, 2009: 1:03 PM ET

NEW YORK (CNNMoney.com) -- The possibility of securing a mortgage rate below 5% has greatly improved in recent weeks, in a positive sign for would-be home buyers.

Home mortgage rates fell for the sixth straight week, according to two key measures, with one of them pointing to a sub-5% rate for the 30-year fixed loan for the second week in a row. more...

The powers (of attorney) that be: What you need to know now

By Harvey S. Jacobs

Special to The Washington Post

Saturday, October 2, 2010

On Oct. 1, the Maryland General and Limited Power of Attorney Act took effect. The changes make it more difficult to delegate a power of attorney, and so this tool can no longer be regarded as a last-minute alternative to attending a real estate closing.

Dubbed "Loretta's Law," the measure was partially the result of one family member abusing the power entrusted to her by her elderly aunt. more...

Friday, October 1, 2010

J.P. Morgan Chase to freeze foreclosures over flawed paperwork

By Ariana Eunjung Cha

Washington Post Staff Writer

Wednesday, September 29, 2010; 11:36 PM

J.P. Morgan Chase, one of the nation's leading banks, announced Wednesday that it will freeze foreclosures in about half the country because of flawed paperwork, a move that Wall Street analysts said will pressure the rest of the industry to follow suit. more...

Washington Post Staff Writer

Wednesday, September 29, 2010; 11:36 PM

J.P. Morgan Chase, one of the nation's leading banks, announced Wednesday that it will freeze foreclosures in about half the country because of flawed paperwork, a move that Wall Street analysts said will pressure the rest of the industry to follow suit. more...

Walking away with less

By Dina ElBoghdady and Dan Keating

Sunday, September 26, 2010; 4:03 AM

A new wave of distressed home sales is rippling, more quietly this time, through American cities and suburbs. Its unsettling effects are playing out here in Manassas, along Brewer Creek Place, a modest, horseshoe-shaped street lined with 98 brick townhouses. Several years after the U.S. foreclosure crisis erupted, the U-Hauls are back.

The last time, banks seized nearly every fourth house on the street through foreclosure. This time, homeowners are going another route: a short sale. more..

Sunday, September 26, 2010; 4:03 AM

A new wave of distressed home sales is rippling, more quietly this time, through American cities and suburbs. Its unsettling effects are playing out here in Manassas, along Brewer Creek Place, a modest, horseshoe-shaped street lined with 98 brick townhouses. Several years after the U.S. foreclosure crisis erupted, the U-Hauls are back.

The last time, banks seized nearly every fourth house on the street through foreclosure. This time, homeowners are going another route: a short sale. more..

Here's more information about the program.

Report gives stimulus package high marks

By Lori Montgomery

Washington Post Staff Writer

Friday, October 1, 2010; 1:38 AM

The massive economic stimulus package President Obama pushed through Congress last year is coming in on time and under budget - and with strikingly few claims of fraud or abuse - according to a White House report to be released Friday. more...

Washington Post Staff Writer

Friday, October 1, 2010; 1:38 AM

The massive economic stimulus package President Obama pushed through Congress last year is coming in on time and under budget - and with strikingly few claims of fraud or abuse - according to a White House report to be released Friday. more...

Monday, September 27, 2010

Products add value to homes without major reconstruction

By Sandra Fleishman

Special to The Washington Post

Saturday, September 25, 2010

Companies at a to-the-trade only remodeling show in Baltimore recently exhibited a variety of products meant to add value to existing homes without major reconstruction. Affordability, energy conservation, green materials and easy maintenance were recurring themes throughout the show.

more...

Special to The Washington Post

Saturday, September 25, 2010

Companies at a to-the-trade only remodeling show in Baltimore recently exhibited a variety of products meant to add value to existing homes without major reconstruction. Affordability, energy conservation, green materials and easy maintenance were recurring themes throughout the show.

more...

Thursday, September 23, 2010

Amid mountain of paperwork, shortcuts and forgeries mar foreclosure process

By Ariana Eunjung Cha and Brady Dennis

Washington Post Staff Writers

Thursday, September 23, 2010; 2:36 AM

The nation's overburdened foreclosure system is riddled with faked documents, forged signatures and lenders who take shortcuts reviewing borrower's files, according to court documents and interviews with attorneys, housing advocates and company officials. more...

Washington Post Staff Writers

Thursday, September 23, 2010; 2:36 AM

The nation's overburdened foreclosure system is riddled with faked documents, forged signatures and lenders who take shortcuts reviewing borrower's files, according to court documents and interviews with attorneys, housing advocates and company officials. more...

Friday, July 16, 2010

Congress passes financial reform bill

By Brady Dennis

Washington Post Staff Writer

Friday, July 16, 2010

Congress gave final approval Thursday to the most ambitious overhaul of financial regulation in generations, ending more than a year of wrangling over the shape of the new rules and shifting the government's focus to the monumental task of implementing them... read more

Washington Post Staff Writer

Friday, July 16, 2010

Congress gave final approval Thursday to the most ambitious overhaul of financial regulation in generations, ending more than a year of wrangling over the shape of the new rules and shifting the government's focus to the monumental task of implementing them... read more

Tuesday, June 29, 2010

Housing Industry Poised to Recover in 2010

Written by: David Lereah Thu, December 17, 2009

Market Activity, Market Commentary

As we approach the New Year, we are more hopeful about prospects for 2010 compared to the dismal performance of 2009. This past year was a year of crises. The economy was on the brink of Depression, shedding 8 million jobs during the past two years, while the unemployment rate climbed sharply to 10 percent (as of this writing) from 4.9 percent. The U.S. credit markets and banking system virtually collapsed, foreclosures became rampant and the housing sector crashed with home values plummeting 10 to 15 percent in most metropolitan areas across the nation.

Government bailouts were commonplace, with taxpayer dollars replenishing the coffers of Wall Street companies, large financial institutions, insurance companies and even the automobile industry. As 2009 draws to a close, we collectively breath a sigh of relief; acknowledging that the economy and housing markets somehow survived. The convoluted maze of government programs and subsidies, a multi-billion stimulus package and an overly accommodative monetary policy conducted by the Federal Reserve heroically kept the economy from falling into the abyss. For all the criticism directed at government decision making throughout the year, something worked. We are in a much better place today than we were yesterday.

As we enter 2010, the economy is rebounding, the credit markets thawing and the housing sector recovering. Read more...

Market Activity, Market Commentary